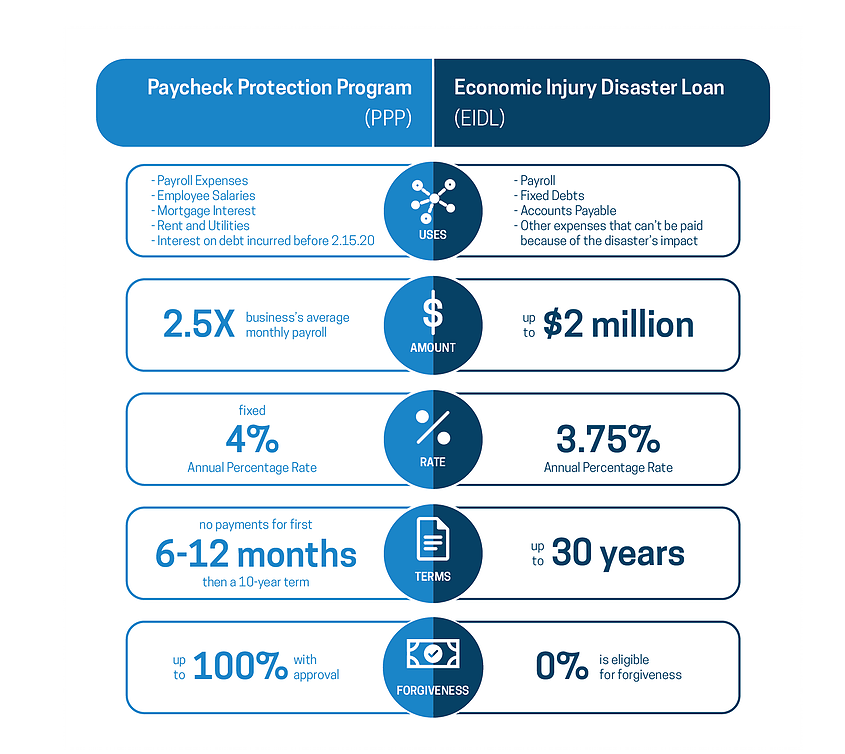

We will help you prepare all the SBA's requested documents that verify the number of full-time equivalent employees and pay rates, as well as the payments on eligible mortgage, lease, and utility obligations.

The SBA requires you to certify that the documents are true and that you used the forgiveness amount to keep employees and make eligible mortgage interest, rent, and utility payments. The lender must make a decision on the forgiveness within 60 days.

We will help to guide you how to properly use the funds received through the PPP program and ensure that ALL or as much as possible will be forgiven.